I have posted this video if you are interested in becoming a more advanced candlestick trader. Even though in 2005, Toby Crabel was described by Financial Time as “the most well-known trader on the counter-trend side,” he still remains an unknown name in the retail industry. Breakout patterns simply refer to instances where price breaks out of an established pattern or reacts to an economic news event.

- It is called a Harami candlestick and the pattern indicates a potential bullish reversal.

- These include the island reversal, hook reversal, three gaps and kicker patterns.

- If you manage to combine the two things, you can develop a candlestick pattern strategy.

- You can develop your skills in a risk-free environment by opening an IG demo account, or if you feel confident enough to start trading, you can open a live account today.

Pivot points are based on three price metrics (close, high, and low) of the previous day, and it is manipulated to create up to seven horizontal lines, which are then plotted on the current day. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn.

Add the EMA technical indicator

Yesterday was trading range price action, which is consistent with this evolution from a bull trend to a trading range. Although the Emini could have a minor new high above last week’s high at some point over the coming month, the probability is that it will be sideways in a 50 – 100 point range. A reasonable initial minimum bottom scalping candlestick patterns is the March 10 higher low of 1958. The opposite is true for the bullish pattern, called the ‘rising three methods’ candlestick pattern. It comprises of three short reds sandwiched within the range of two long greens. The pattern shows traders that, despite some selling pressure, buyers are retaining control of the market.

Technically speaking I am looking for more downside continuation upon the retracement of the monthly candle (orange Fib). Candlesticks are the building blocks of what will later become a swing high or swing low. The swing or swing low in turn can either be impulsive / momentum OR corrective / consolidation. The candlestick patterns usually occur at the bottom or top of these swing highs and swing lows, but can also provide information of continuation. Also, candlestick patterns often indicate the beginning and end of momentum and corrections. The pump and run are the best candlestick patterns for swing trading.

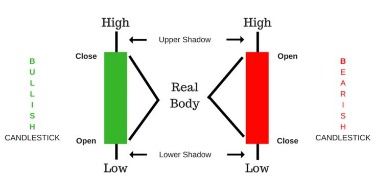

Bullish/Bearish Engulfing Lines

The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend. Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. You could sustain a loss of some or all of your initial investment and should not invest money that you cannot afford to lose.

The Spike and Ledge pattern by Linda Raschke is the best candlestick pattern for cryptocurrencies. Every crypto trader should know this pattern especially if you want to keep up with the volatility in the cryptocurrency market. This post reviews those interesting opportunities and conclusions on the majors which we can learn from for future trades to find setups based on candlesticks formations of the major forex pairs. With the start of a new month, Forex traders have the luxury of analyzing new monthly candlesticks and patterns. Even though the ORB NR4 pattern tends to lead to trend trading days, we’re more conservative and want to quickly take profits.

Do you have trading data, looking for a way to effectively visualize it for your website or app project? This tutorial will break down the process needed to create such a chart into simple steps and provide a detailed explanation of the code. Keep reading even if you are new to programming, because only a basic understanding is needed to follow along and master such a JavaScript (HTML5) based data visualization technique. When scalping, traders have to keep a high concentration on the execution of trades while some supplementary routine can be maintained by automated software.

How much does trading cost?

The only difference being that the upper wick is long, while the lower wick is short. Especially in the realm of forex scalping, the butterfly pattern, when correctly identified and used, can prove to be an incredibly effective tool. Trading with the butterfly pattern typically involves placing a stop loss just beyond point ‘D’, and targeting at least a 38.2% retracement of the ‘C-D’ swing for a profitable exit. Spotting a butterfly pattern involves following a sequence of Fibonacci retracement and extension levels. The pattern typically surfaces at the culmination of a trend, with point ‘D’ marking the potential reversal point. This might be an opportunity to enter a long trade and ride the potential bullish reversal.

Confirmation of a short signal comes with a dark candle on the following day. The key is that the second candle’s body “engulfs” the prior day’s body in the opposite direction. This suggests that, in the case of an uptrend, the buyers had a brief attempt higher but finished the day well below the close of the prior candle. This suggests that the uptrend is stalling and has begun to reverse lower. Also, note the prior two days’ candles, which showed a double top, or a tweezers top, itself a reversal pattern. Having some definable rules of entry based on candlestick patterns can really help the aspiring trader.

Step 3: Prepare the data

Once price has broken and closed above the upper part of the flag pattern, scalpers may then proceed to place a buy order a few pips above the candlestick that closed above the upper trendline. The double-top pattern is a popular reversal pattern that forms in all types of charts. When it forms, it is usually a sign that a financial asset will soon reverse and start moving in the opposite direction. Bullish and bearish flag patterns are made up of a “pole” and a “flag”. When they happen, traders assume that the chart pattern will continue moving in the existing direction. Long-term traders use the strategy to identify opportunities to buy or short.

In another instance, imagine a forex scalper identifying a completed bullish butterfly pattern. As the price starts ascending above point ‘D’, the trader decides to go long on the pair. The trader sets a target of 38.2% retracement of the ‘C-D’ swing, subsequently securing a profit within minutes. If you’re on a quest to enrich your scalping skills, certain patterns are essential to your trading repertoire.

Best candlestick patterns for swing trading?

A hanging man pattern suggests an important potential reversal lower and is the corollary to the bullish hammer formation. The story behind the candle is that, for the first time in many https://g-markets.net/ days, selling interest has entered the market, leading to the long tail to the downside. The buyers fought back, and the end result is a small, dark body at the top of the candle.

Scalping vs. Swing Trading: What’s the Difference? – Investopedia

Scalping vs. Swing Trading: What’s the Difference?.

Posted: Sat, 25 Mar 2017 19:16:54 GMT [source]

There is about a 30% chance that the rally will continue up to a new all-time high without forming a trading range first. This information has been prepared by IG, a trading name of IG Markets Limited. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. IG accepts no responsibility for any use that may be made of these comments and for any consequences that result. No representation or warranty is given as to the accuracy or completeness of this information. Consequently any person acting on it does so entirely at their own risk.

Practise reading candlestick patterns

If you manage to combine the two things, you can develop a candlestick pattern strategy. Looking at a weekly USDJPY chart, you will notice that we have embedded weekly Master Candles set up. For those of you unfamiliar with Master Candles, they are candles that engulf the next four following candles.