Contents:

Therefore, the search results displayed by the Planner cannot be construed to be entirely accurate / comprehensive. You also acknowledge and agree that, unless specifically provided otherwise, these Terms of Use only apply to this Website and facilities provided on this Website. Higher leverage entails higher bankruptcy risk and we have seen many companies in the steel, infrastructure and textile sectors pay a huge price for reckless borrowing in the last 10 years. In fact, if banks write off these loans it may actually impel companies to continue to borrow recklessly and create moral hazard.

If the opposite occurs, and curiosity payments are larger than the return on investment, the corporate may possibly be put into a dangerous threat scenario – and may even face bankruptcy. Leverage outcomes from utilizing borrowed capital as a funding source when investing to broaden the agency’s asset base and generate returns on risk capital. Leverage is an investment technique of using borrowed money—particularly, the usage of numerous monetary devices or borrowed capital—to extend the potential return of an funding. Statistics similar to return on fairness, debt to fairness and return on capital employed assist buyers decide how companies deploy capital and the way much of that capital companies have borrowed. To properly consider these statistics, it is important to remember that leverage is available in several varieties, together with operating, financial, and combined leverage. An particularly vital leverage problem exists with intrinsically extra volatile investments, similar to hedge funds.

Debt can be utilized as leverage to exponentially multiply your returns. Leverage is utilizing borrowed money to increase your return on investment. Leverage can allow you to obtain returns that you thought have been inconceivable, however at a higher threat of losing your capital. Financial leverage is only favourable if the firm is able to generate higher returns than the fixed financial cost. The purchasing and selling of currencies for profit is known as foreign exchange or forex. As forex trading involves such minor changes, many people prefer to trade with leverage.

The more debt a company takes on, nevertheless, the extra leveraged that firm turns into. It magnifies the adjustments in financial variables like sales, prices, EBIT, EBT, EPS, and so on. The firms which use debt content in its capital structure are regarded as Levered Firms, but the company with no debt content in its capital construction is named Unlevered firms.

Types of Leverage: Advantages and Disadvantages

Leverage can also refer to the amount of debt a firm uses to finance assets. A firm can increase its FL by using more financial instruments bearing fixed costs like debentures and preference share capital. A firm with a high financial leverage will see a high fluctuation in its EPS than a firm with a low financial leverage. Leverage meaning in stock market is essentially a chance to pump up the returns on your trade.

Our GST Software helps CAs, tax experts & business to manage returns & invoices in an easy manner. Our Goods & Services Tax course includes tutorial videos, guides and expert assistance to help you in mastering Goods and Services Tax. ClearTax can also help you in getting your business registered for Goods & Services Tax Law. Paytm likely to clock sustained growth in Q4 operating profitability, says Citi; raises target priceCitibank has raised its target price for Indian fintech Paytm to INR1,103 ($14.60), signalling a potential upside of 71%. After breaking even last year, Citibank expects Paytm’s growth to continue, partly thanks to recognition of annual UPI payouts from the Indian government, along with decent Q4 figures.

Very often, people tend to think only about the left side of their balance sheet and forget right side. Thinking more like a corporate magnate and employing leverage in strategic ways can help individual investors swell their profits. Along with investments and wealth planning, credit and leveraging is just another bullet in the barrel for the savvy investor. That’s primarily because of the larger interest payments owed to the lender by the borrowing enterprise. Yet if the leverage results in a higher investment return, in comparison with the speed of interest a company is paying on a loan, the extent of leverage is lowered.

Get ₹ 250 off on online purchase*

Using what do you mean by leverage means that you borrow capital from your forex broker or a connected third party, with which you can open much larger trades than which you would have been able to open without access to any leverage. The forex market is generally much less volatile than, for example, stock markets. This Website is provided to you on an “as is” and “where-is” basis, without any warranty. Similarly, if financial leverage is high, they can make more profits when their sales increases. It helps management to understand how their profits will react to change in sales.

Offer details as shown are based on information provided by the Merchant. Please check directly with Merchant to confirm the availability and validity of the Offer. Download the PDF Question Papers Free for off line practice and view the Solutions online. Find a reliable collection of Management Notes, Ebooks, Projects, Presentations, Video Tutorials and lot more, compiled from a variety of books, case studies, guidance from management teachers and of course the internet to make your management studies a joyride.

But it saves lots of times and provide instant tools for people at the top management level to make quick decisions. CFOs use this tool to know what will be direct impact in EBT when your sales changes. It says, when sales increases, EBT will increase by Combined Leverage Times.

EOG Resources (EOG) Q1 2023 Earnings Call Transcript – The Motley Fool

EOG Resources (EOG) Q1 2023 Earnings Call Transcript.

Posted: Fri, 05 May 2023 20:30:34 GMT [source]

You acknowledge that the Website does not pre-screen content, but that the Website will have the right in their sole discretion to refuse, edit, move or remove any content that is available via the facilities. You are advised to be cautious when browsing on the internet and to use good judgment and discretion when obtaining information or transmitting information. From this Website, users may visit or be directed to third party web sites. The Website makes no effort to review the content of these web sites, nor is the Website or its licensors responsible for the validity, legality, copyright compliance, or decency of the content contained in these sites.

Leverage Meaning in Share Market

However, there are chances of increasing potential losses; in case if the trade fails significantly, a person will lose an enormous amount of the borrowed money. Leverage trade is generally referred to as the ratio between the money invested and the amount of money allowed to trade after taking the debt. The sum amount invested in the trade is called the initial margin, and the amount of money kept in the margin account is referred to as the maintenance margin.

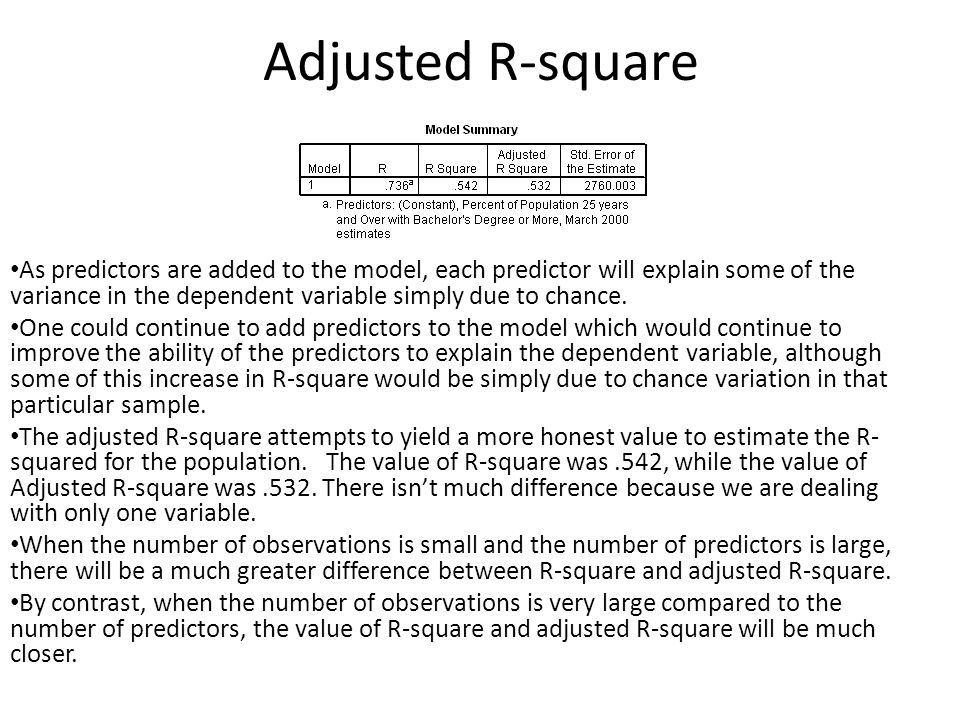

Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. In the first year, if EBIT was 20% higher, the EBT would also be 20% higher due to zero debt. However, in the second year, a 20% increase in EBIT levels results in a 28% increase in EBT. That is due to the impact of borrowing which results in fixed interest costs. Companies that borrow are able to show better growth in profits due to the impact of DFL.

The unsatisfactory mounting debt commitments and pay operational expenditures due to income changes might quickly force a corporation into debt and liquidation. Because of unpaid bills looming, creditors may launch a petition in bankruptcy proceedings to have the firm assets sought to sale for recovering their obligations. All Personal Information including Sensitive Personal Information provided/related to you, shall be stored/used/processed/transmitted expressly for the Purpose or facilities indicated thereon at the time of collection and in accordance with the Privacy Policy.

So if your sales increases, your EBIT will grow by Operating Leverage Multiples. Assume 30% fall in your sales, when your fixed cost is Rs.40 Crs and sales is Rs.100 Crs. More contribution for every additional sales but fixed cost will be fixed. If the business environment is very conducive and if there is scope for achieving growth in sales, then business entities can take more fixed cost. So, the message is if you have more contribution and if you have more fixed cost, you tend to make more profits.

Get Flat 20% OFF on purchase of any course/ practice test*

Irrespective of whether the firm earns sales, it must pay operating expenses such as equipment depreciation, manufacturing facility overhead, and maintenance expenditures. In most circumstances, the financing provider will limit the risk it is willing to assume and the amount of leverage it will accept. Asset-backed lending involves the financial provider using the borrower’s assets as a security deposit until the loan is repaid. In the event of a working capital loan, the company’s overall creditworthiness is utilised to secure the loan.

Cinemark (CNK) Q1 2023 Earnings Call Transcript – The Motley Fool

Cinemark (CNK) Q1 2023 Earnings Call Transcript.

Posted: Fri, 05 May 2023 16:00:29 GMT [source]

We collect, retain, and use your contact information for legitimate business purposes only, to contact you and to provide you information & latest updates regarding our products & services. “KYC is one time exercise while dealing in securities markets – once KYC is done through a SEBI registered intermediary (broker, DP, Mutual Fund etc.), you need not undergo the same process again when you approach another intermediary.” Investors may please refer to the Exchange’s Frequently Asked Questions issued vide circular reference NSE/INSP/45191 dated July 31, 2020 and NSE/INSP/45534 dated August 31, 2020 and other guidelines issued from time to time in this regard. Firstly, you may be required to maintain a specific amount as minimum balance, as required by your brokerage firm. However, you can’t use leverage on each and every stock in the market. SEBI has a separate list of stocks mentioning the ones that can be bought on leverage.

Leveraging allows the multiplication of your profits or your losses. It runs the risk of incurring a loss, when the costs exceed the income from an asset, or when the value of said asset reduces. It is mostly used to boost the returns on equity capital of a company, especially when the enterprise is unable to increase its operating efficiency and returns on total funding. Degree of financial leverage –It may be defined as the percentage change in taxable profit as a result of percentage change in earnings before interest and tax .

The Facilities Provider, ABC Companies or any of its third party service providers and processor bank/merchants etc. shall not be deemed to have waived any of its/their rights or remedies hereunder, unless such waiver is in writing. No delay or omission on the part of Facilities Providers and ABC Companies, in exercising any rights or remedies shall operate as a waiver of such rights or remedies or any other rights or remedies. A waiver on any one occasion shall not be construed as a bar or waiver of any rights or remedies on future occasions. No Information at this Website shall constitute an invitation to invest in ABCL or any ABC Companies.

The Website reserves the right to withdraw, discontinue, modify, extend and suspend the Promotional Offer and the terms governing it, at its sole discretion. Leveraged funds function by using conventional brokerage accounts wherein investors borrow money to purchase stocks with the objective to maximise gains. For instance, an investor buys mutual funds worth Rs.1 lakh and borrows Rs.50,000 additionally with the objective to increase exposure. Forex brokers are known to offer high leverage because the foreign exchange market is blessed with high liquidity. The term leverage ratio is used to describe several measures of a company’s financial leverage. Also known as gearing, leverage measures the amount of debt a company has issued relative to other capital such as equity.

This is good when working income is rising, however it can be a problem when operating income is underneath strain. A diploma of economic leverage is a leverage ratio that measures the sensitivity of an organization’s earnings per share to fluctuations in its working revenue, as a result of adjustments in its capital construction. The diploma of financial leverage measures the proportion change in EPS for a unit change in working income, also referred to as earnings before curiosity and taxes . Investors use leverage trades to amplify their returns through options, margin, or future accounts, companies use leverage trades to finance assets with the help of debt financing to invest in several major operations and increasing valuations of equity. The inclusion of the fixed cost capital along with equity share capital in the capital structure is called financial leverage.

- The Merchant is the sole provider of all goods and/or services under this offer.

- It is your responsibility to decide whether any facilities and/or products available through any of these websites are suitable for your purposes.

- It is a useful tool in the hands of the finance manager when determining the amount of debt in the firm’s capital structure.

- Managing risk during margin trading is another crucial factor to consider.

- Investments in securities market are subject to market risk, read all the related documents carefully before investing.

Understanding its benefits and drawbacks will help you expand your business and determine whether your company is ready to use this financial tool just yet. Because current assets are less profitable than fixed assets, this is the case. A high degree of operating leverage magnifies the effect of a small change in sales volume on EBIT.

If the sum amount falls below the value, the broker will call to either deposit more money or pay back all the loan by using the leftover funds or liquidating investment in a practice known as a margin call. An investor has to open a margin account to buy on margin and make a small initial investment. Degree of Combined Leverage is the percentage change in a firm’s earning per share to the percentage change in sales of the firm. Financial BEP is the level of EBIT which covers all fixed financing costs of the company.